973-994-3030

Expert Legal Services From an Attorney Who Makes a Difference.

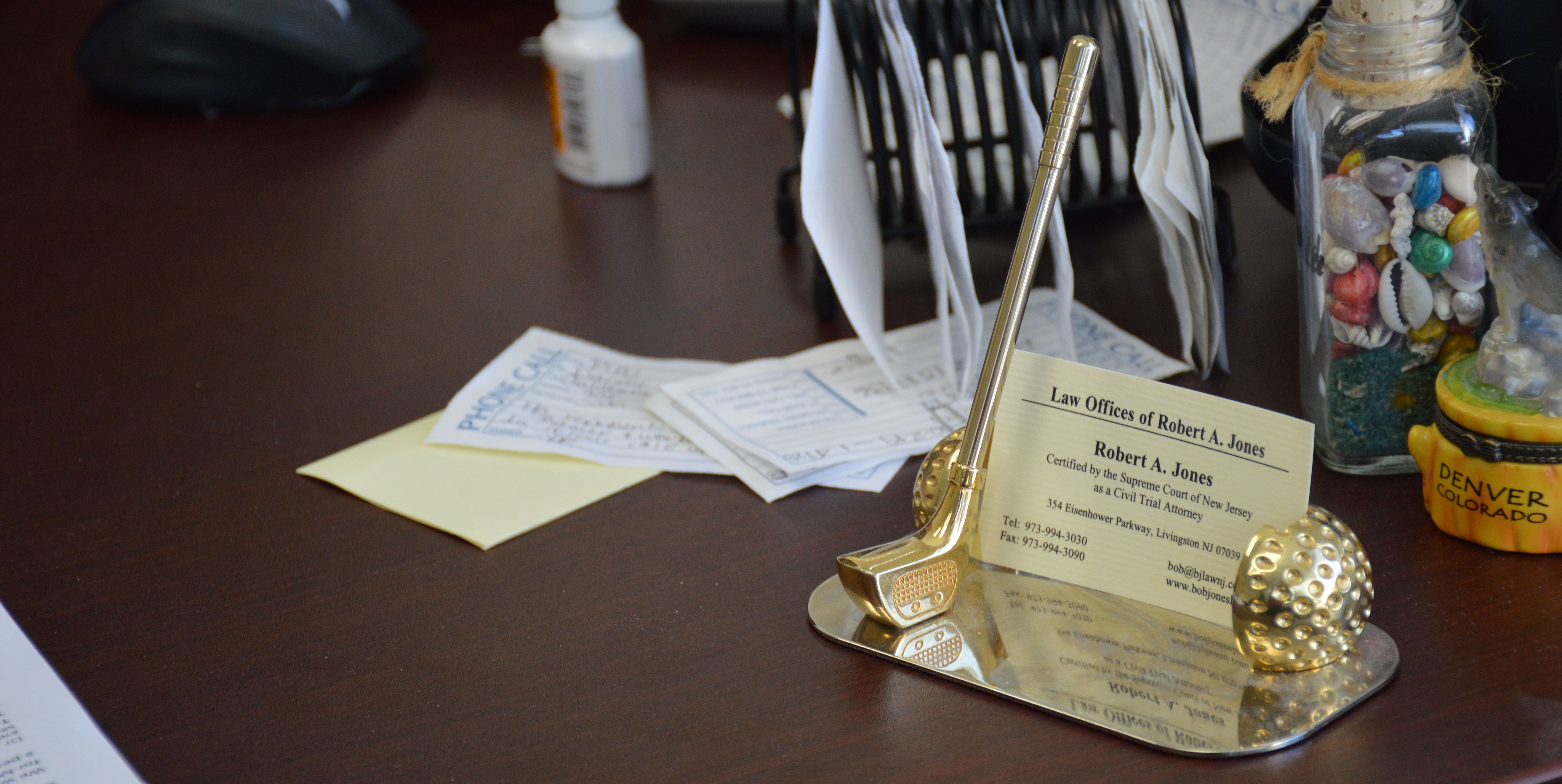

I am a Civil Trial Attorney, certified by the Supreme Court of New Jersey. I provide expertise in personal injury, medical malpractice, and business law cases. Contact my office to learn how I can make a difference in your case.

Expert Legal Services From an Attorney Who Makes a Difference.

I am a Civil Trial Attorney, certified by the Supreme Court of New Jersey. I provide expertise in personal injury, medical malpractice, and business law cases. Contact my office to learn how I can make a difference in your case.

Personal Injury, Malpractice, and Business Litigation Representation

Any legal issue can cause harm to an individual's finances, reputation and future. If you are facing a legal issue, seek out the legal guidance and representation you need from a dedicated lawyer who will always work hard for you.

I'm Robert A. Jones, an Essex County trial attorney. For more than 35 years, I have been helping people who have been injured due to the negligence of others. I also represent people who have lost family members in a fatal accident. In addition to my personal injury practice, I represent individuals in a variety of other areas, including business litigation, medical and legal malpractice cases, nursing home abuse and neglect cases, and employment discrimination and sexual harassment cases.

To learn how I can help you with your legal concern, call 973-994-3030 today. I serve clients throughout northern and central New Jersey.

Other attorneys rated Mr. Jones AV Preeminent, indicating the highest level of skill and integrity.

Mr. Jones is certified by the Supreme Court of New Jersey as a Civil Trial Attorney.

Mr. Jones is a member of the Million Dollar Advocates, achieved by earning many million-dollar settlements.

Mr. Jones has been included in the Super Lawyers list from 2007-2014 and 2016-2022.

Personalized Service from a Dedicated Legal Team

As a small firm, I handle all of my cases personally. Since I do not have a large volume practice, I provide personal attention to each client and to each case. All phone calls from clients are usually returned the same day and all questions are answered thoroughly.

In addition, I have a strong, experienced support staff that provides all of my clients with the personal attention they deserve. You can rest assured that someone in this office will always be available to you when you need us.

Settlements & Verdicts

$3

million dollars

wrongful death case resulting from motor vehicle collision.

$2.45

million dollars

explosion/burn case.

$1.5

million dollars

wrongful death of construction worker at construction site.

$1.4

million dollars

motorcycle accident resulting in death.

Lawyer Recognized for Skill and Experience

The legal community has acknowledged my skill and experience on several levels. While such acknowledgement does not guarantee specific results for any client, it can help you see how my work has been viewed within the legal community. Since 1995, I have been Certified as a Civil Trial Attorney by the Supreme Court of New Jersey for my experience in and knowledge of civil trial practice. After achieving seven-figure settlements in my personal injury practice, I became a member of the Million Dollar Advocates Forum, a national group of trial lawyers who have obtained million-dollar and multimillion-dollar verdicts and settlements.

I have been named to the Super Lawyers* list in New Jersey Monthly magazine in 2007-2014 and 2016-2020. I am rated AV Preeminent* by Martindale-Hubbell and am listed in its Bar Register of Preeminent Lawyers.

Lawyer Recognized for Skill and Experience

The legal community has acknowledged my skill and experience on several levels. While such acknowledgement does not guarantee specific results for any client, it can help you see how my work has been viewed within the legal community. Since 1995, I have been Certified as a Civil Trial Attorney by the Supreme Court of New Jersey for my experience in and knowledge of civil trial practice. After achieving seven-figure settlements in my personal injury practice, I became a member of the Million Dollar Advocates Forum, a national group of trial lawyers who have obtained million-dollar and multimillion-dollar verdicts and settlements.

I have been named to the Super Lawyers* list in New Jersey Monthly magazine in 2007-2014 and 2016-2020. I am rated AV Preeminent* by Martindale-Hubbell and am listed in its Bar Register of Preeminent Lawyers.

For a Free Consultation with a Certified Trial Attorney

Call The Law Offices of Robert A. Jones at 973-852-3352 or fill out our simple contact form.

* Super Lawyers is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high-degree of peer recognition and professional achievement. The patented selection process includes independent research, peer nominations and peer evaluations.

*AV®, AV Preeminent®, Martindale-Hubbell Distinguished and Martindale-Hubbell Notable are certification marks used under license in accordance with the Martindale-Hubbell certification procedures, standards and policies. Martindale-Hubbell® is the facilitator of a peer-review rating process. Ratings reflect the anonymous opinions of members of the bar and the judiciary. Martindale-Hubbell® Peer Review Ratings™ fall into two categories – legal ability and general ethical standards.